COVID-19 brought corporate travel to a standstill and there are major concerns that business travellers may never fully return to their pre-pandemic ways.

A key component of the commercial aviation business model may be permanently threatened by the COVID-19 crisis.

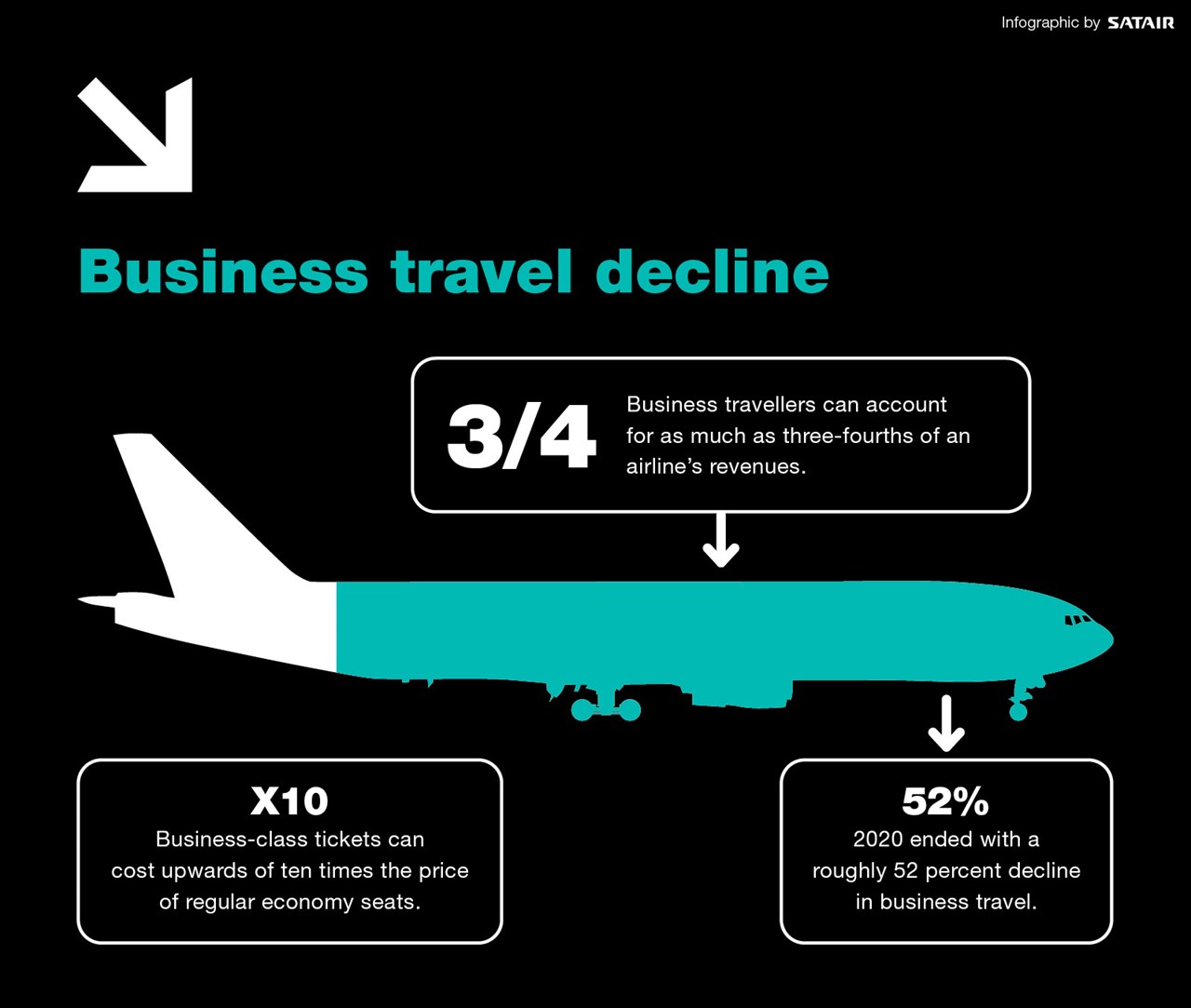

Business travellers can account for as much as three-fourths of an airline’s revenues. But the travel restrictions and safety concerns brought on by the pandemic led to precipitous drops in business travel in 2020. Companies worldwide cancelled all non-essential trips during the crisis, and the year ended with a roughly 52 percent decline in business travel.

Although we now appear to be entering the final stages of the pandemic, there are numerous indications that business travel demand will take years to rebound – if it bounces back at all.

RELATED ARTICLE:

Three ways airlines might respond to the loss of business passengers

Cancelled trips and fewer options

At Lufthansa City Center (LCC), a business-focused travel agency network with operations in 86 countries, the drop in corporate travel has been enormous.

“As corporates around the globe announced travel bans, the demand for business travel came to a standstill for all non-essential travel,” LCC senior director for sales steering Siiri Palisaar told the Knowledge Hub. “Overall, the turnover in corporate business [at LCC] in 2020 dropped by 75 percent in comparison to the previous year.”

Palisaar added that some industries like healthcare and oil and gas were still travelling for business throughout the pandemic but booking trips for those clients was difficult given the declines in capacity and travel options.

Even the most optimistic predictions call for one-fifth of business travel never returning, thanks in large part to a global shift in workplace behaviours. Now that videoconferencing has become an everyday part of working life, many companies are likely going to think twice about purchasing airline tickets for their employees when a Zoom meeting would do the trick.

Can virtual meetings really replace personal contact?

Palisaar said the upper market clientele she works with will almost certainly want to resume in-person meetings when possible.

“Once travelling is possible, we believe that customers will expect to meet business contacts again in person, both for new business opportunities and for existing relationships,” she said. “From our conversations with clients around the world, we understand that in the long-run, virtual formats cannot replace personal interaction.”

That opinion is not universal, however. Some have argued that greatly reducing or eliminating work travel is actually beneficial. It’s much easier to coordinate a video meeting than arrange travel plans and taking meetings virtually eliminates employees’ lost time, like transport to and from the airport, waiting in security, checking into hotels and so on.

But it’s not just the rise of videoconferencing that is driving down the demand for business travel.

Although the pace of vaccinations has led to an easing of travel restrictions and lockdowns in Western countries, much of the rest of the world still lags behind. Workers in many countries are also beginning to return to their physical offices after more than a year of remote work, but this is happening slowly and in stages, creating logistical challenges for in-office meetings.

And while some major convention destinations like Las Vegas are back to hosting events, large convention-style professional events and trade shows are still likely months away from returning in full force. All of these factors will continue to depress the global demand for business travel.

Five years – or never?

Just how long it will take for business travel to bounce back is the subject of much debate.

Some analysts and industry insiders think that anywhere between 20 to 40 percent of demand will never return, some predict that demand will fully bounce back within five to 10 years while others say that business travel as we knew it pre-pandemic is likely gone forever.

In the United States, where the vaccination programme has picked up speed and facemask and distancing requirements have been dropped in many states, airlines are cautiously optimistic. An American Airlines spokeswoman told the Wall Street Journal in June that 47 of its 50 biggest corporate accounts have told the airline that they plan to resume travelling this year. Representatives from both United and Southwest also told the Journal that they are already seeing signs that business travel is returning.

The corporate world seems similarly split on the return of business travel. In a survey conducted by CNBC, nearly half of all technology executives predicted that their companies’ employee travel budget would return to pre-pandemic levels within the next two to three years, while 20 percent said their companies would never again spend on travel like they did before the crisis. Chief financial officers (CFOs) contacted by the broadcaster were significantly less optimistic, however, with 47 percent of CFO respondents saying that their companies’ travel budgets would never return to pre-pandemic levels.

Lessons from history

An April report from McKinsey forecasted that business travel would crawl back up to 80 percent of pre-pandemic levels by 2024 and added that that history doesn’t bode well for the business travel sector.

“In previous crises, leisure trips or visits to friends and relatives tended to rebound first,” it stated. “Not only did business trips take four years to return to pre-crisis levels after the attacks on the World Trade Center but they also had not yet recovered to pre-financial-crisis levels when COVID-19 broke out in 2020.”

Neither 9/11 nor the recession of 2008 had anywhere near the impact on business travel that the global pandemic did. Business travel dropped by 11 percent after the terror attacks and by eight percent after the Great Recession but plummeted by 89 percent in the immediate aftermath of COVID-19.

That is undeniably a much steeper hole from which to climb, but the situation has already improved significantly over that initial low point.

Palisaar said that LLC is currently experiencing increased interest in business travel even though bookings remain slow. She anticipates that the constantly evolving pandemic and vaccination situations mean that corporate travel arrangements will be booked on much shorter notice than in previous years.

“As the pandemic is not yet over, it is too early to predict when business travel will return to the 2019 levels,” she said.

Palisaar added that small and mid-size enterprises (SMEs) are likely to resume travelling sooner than larger corporations, which often have stricter travel compliance policies. She expected LCC to be back at its pre-pandemic numbers in as little as three years thanks in large part to the agency’s SME customer base.

The Satair Takeaway

Many appear ready to predict the end of business travel. They could be right. Recent history tells us that when crises strike the aviation industry, business travel is the slowest to bounce back. And none of the industry’s previous woes have come close to the pandemic’s impact.

But it’s perhaps too early to sound the death knell just yet. The rapid pace of the vaccination rollout in the West has shown us that many things that felt far off – ditching masks, dining out, hugging friends – can come roaring back quicker than expected. The industry can’t just sit back and hope for the best though, and is already being forced to consider how to react to a serious threat to its business model.