Airlines and aircraft repair shops are increasingly relying on used aircraft parts to keep jets flying, a symptom of the rising costs and supply-chain shortages plaguing the aerospace industry. As higher costs and supply chain delays drive demand for used parts, interest in the Used Serviceable Material (USM) continues to be one of the fastest-growing segments of the worldwide MRO industry.

With the industry driving a trend to achieve greater savings on maintenance, the USM segment will continue with that upward growth, as airlines continue to fly mature aircraft types for longer than expected. This has led to parts specialists investing more resources into expanding this part of their businesses. In 2019, Satair expanded its used-parts offer with a multi-channel approach.

Out with the old, in with the new

USM has some real advantages for both those who are looking to maximise their ROI on fleets nearing retirement, as well as for those who are looking to extend their initial provisioning packages when acquiring similar aircraft. As new aircraft come into the market, older aircraft will be retired and parked for dismantling. These annual aircraft retirements are expected to reach over 1,000 aircraft per year by 2030.

As fleets near retirement, MRO tends to become less cost-effective and utilising USM can squeeze the last bit of revenue out of an aircraft. The salvage of older aircraft also has the potential to increase MRO production as well, as savaged parts will still need to be checked through an MRO process before being offered on the used-parts market.

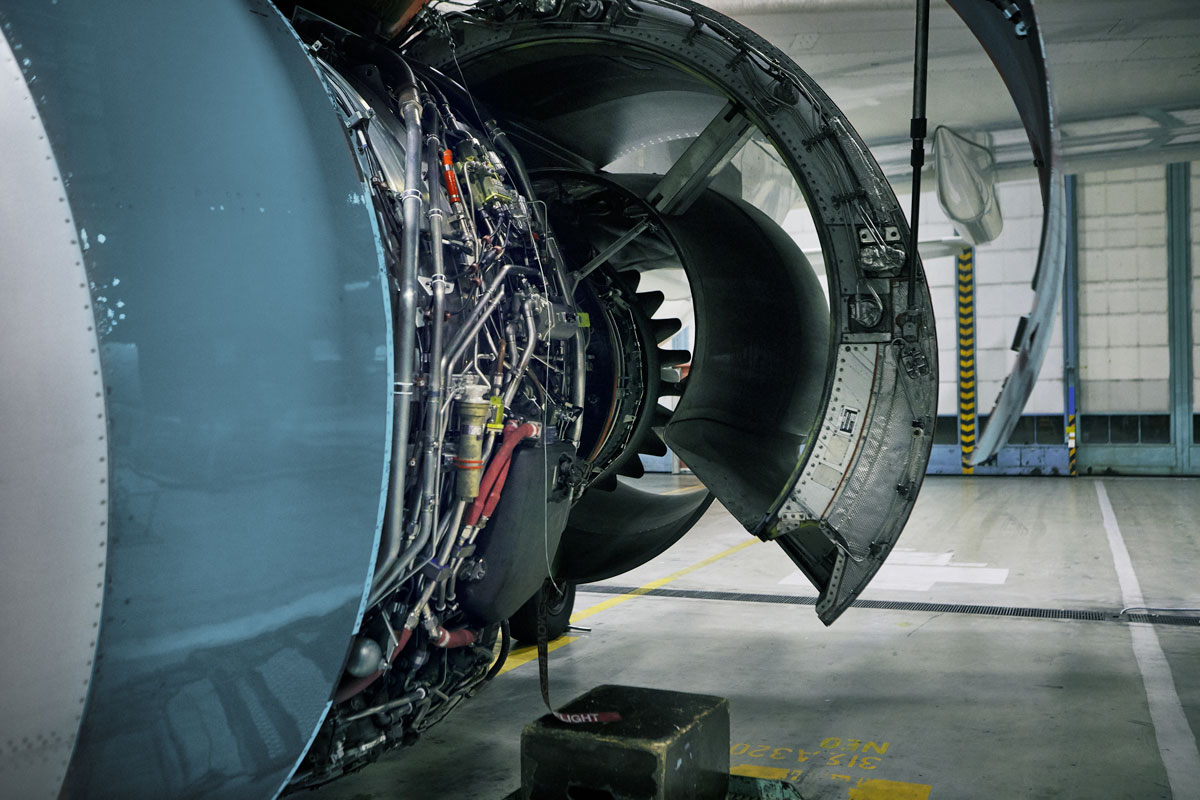

It’s the engine that’s driving the market

Contrary to many other areas of the market, the USM market fluctuates with the number of fleet renewals against the number of aircraft part-outs, rather than the number of operational aircraft. This means that an aircraft’s USM market value will continuously fluctuate depending on supply and demand. According to our figures, though, engine segments represent 70% of the surplus market, with 20% components and 5% airframe parts.

There has been a gradual decrease in the last years in engine retirement, with just 428 air transport aircraft globally recognised as retired in 2022, the lowest level since 2007. This decrease has sparked a demand for cheaper materials and more USM.

These factors have created a hot market, to which many Tier 1 suppliers are shifting their gaze Although an Airbus subsidiary, Satair is becoming an industry leader in the USM segment, and with the expansion of its used-parts business, it's fast becoming a multi-fleet and multi-platform provider.

Addressing quality and traceability

It goes without saying that in order for the USM market to continue to grow, the ability to ensure parts quality, certification and repair history must remain an essential part of the procurement process. This can present some challenges, as the MRO industry still struggles to catch up with going digital – leaving used-parts suppliers with documentation and repair records spread across paper trails and digital files. We address some of the challenges that MRO faces in regard to moving into a digital format in this article: Could a world of purely digital MRO be stranger than fiction?

Regardless of the challenges of wading through sometimes decades of service documentation, there remains tremendous potential in the aviation used-parts market. Addressing the issue of quality and traceability has been a paramount factor for Satair’s offer. It ensures that all Airbus proprietary parts come with an EASA Form 1 Certificate, while for non-Airbus material, certificates will come from authorised repair shops and facilities and sometimes also the original OEM.

The big picture

While the most significant interest in USM has traditionally come from North America and Europe, due to these regions having the oldest fleets on the market, Asia-Pacific and China are now growing in demand.

What we can take from this is that both supply and demand for used parts will continue to grow throughout the industry for the foreseeable future – and that there is real potential for both airlines and suppliers to get in on the action.