According to the 2023-33 fleet forecast from Oliver Wyman, the size of the global in-service commercial airline fleet stands at close to 27,400 – a little shy of pre-pandemic levels. Projected to surpass 2019 levels soon, the number is forecast to increase to 36,000 aircraft by 2033.

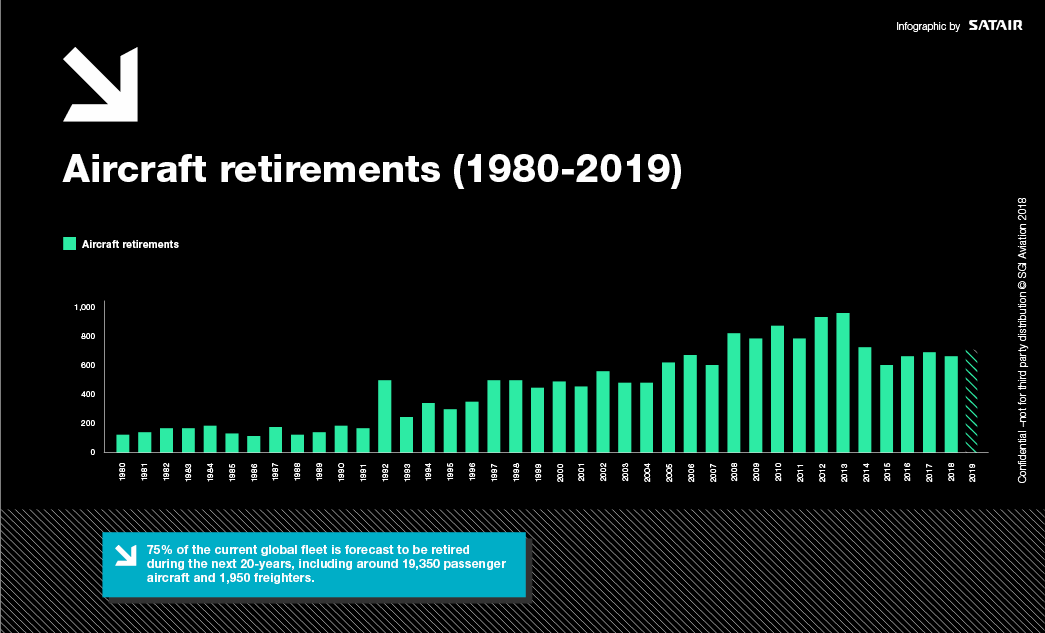

Retirement rates are also accelerating. According to figures released by International Air Transport Association (IATA), the annual rate has grown from an average of 460 over the past 35 years to 700 today, and by 2033 it predicts it will rise further to 1,100.

Given that the average lifespan of a commercial aircraft today is 20-25 years, during which time it will travel an estimated 40 million km, it’s not surprising to note that 75 percent of the current fleet will be retired by 2040, according to Flight Global – particularly in light of the plans of major airlines such as Emirates – 200 narrow-body aircraft on order for the end of 2025, and 100-150 wide-body jets between 2027 and 2033 – to more or less replace their fleets.

Retirements continuing at a pace

Retirements have been increasing among the major airlines since the onset of the pandemic – particularly in regards to wide-body planes.

In 2020, Virgin Air retired the last of its A340s, Air France said adieu to its final A380 and British Airways bid cheerio to the last of its 747s – as did KLM a year later. And that was only the beginning.

Qatar Airways plans to retire its fleet of Airbus A380 superjumbos, which it considers a massive gas guzzler, over the next few years. All 10 were grounded in 2020, but eight have since been reactivated.

Qantas has confirmed it will scrap the last of its 12 A380s in 2032. Since the onset of the pandemic, it has already deactivated two of them – a logical move as constraints with maintenance, repairs and overhaul services dramatically slowed down their reactivation.

Emirates, which retired five of its 120 iconic A380s in 2021, has also said all of them will be deactivated by 2032. Its course of action was mostly spurred by Airbus ceasing production in 2021 due to insufficient demand. But a recent $2 billion retrofit might have changed its tune: now it thinks some of the A380s could continue into the 2040s.

And the same trend can be seen with wide-body cargo planes. Just this June, FedEx confirmed it is retiring nine MD-11 freighters from its fleet – with another 20 to follow over the course of the next year. It expects all 46 of its MD-11s to be phased out by 2027 or 2028.

Disassembling, dismantling and recycling also increasing

Certainly, all of this poses some pressing questions regarding the effect on the emerging USM (used serviceable material) market.

The commercial aircraft disassembling, dismantling and recycling market is expected to grow at a CAGR of 7.85 percent until 2032, according to a 2023 industry report – a significant hike on the CAGR of 4.80 percent forecast for the same period just 12 months earlier.

According to the Commercial Aircraft Disassembly, Dismantling and Recycling Market Report 2023-2033, the value of the market, which stood at $5.95 billion in 2021, will grow to $14.35 billion by 2032. Its resurgence followed a 12.13 percent decline in 2020.

The figures reflect how the pandemic has accelerated the decommissioning of planes (50 percent narrow body, 28 percent wide body).

In many cases, the decommissioning of planes has been the next logical step following their deactivation due to the corona-fuelled lack of demand. Disassembling, dismantling and recycling the parts of the planes are a perfect fit for the increased focus of the industry on greener and cost-effective solutions.

It’s a welcome development for Used Serviceable Material (USM) suppliers, which are making use of recent advancements in machine learning and robotics to strip the aircraft of nearly 80 percent of its components.

The boom in USM is having a positive impact in a number of areas:

- Better repair/refurbishment of rotable components

- Improving overall inventory management

- Increased focus on recycling and storage operations

USM as a flourishing market

At this year's MRO Europe, where representatives of major stakeholders will gather in Amsterdam from October 17-19, the discussion concerning the increase in aircraft retirements will continue. It’s generally agreed the quick rate of retirements will present some real opportunities for the USM market – but they won’t come without a few challenges.

The USM market continues to position itself as one of the fastest-growing MRO segments. With the host of projected retirements feeding this market, there are tremendous opportunities that will bolster the health of the MRO industry, because USM has the potential to reduce material costs across the board.

When asked whether they saw increased interest in USM from their customers, Carrie Kendrick, VP Aftermarket Services at Honeywell, had this to say:

"Absolutely. What is funny is that it's also a little incongruous, as customers who are buying new aircraft for the appeal of new technology are also requesting USM solutions. This is leading to a trend in which 45 percent of the new aircraft are actually going to be replacement aircraft. In addition, if you look at some of the data provided by McKinsey, it reveals that available seat miles are projected to go up 7 percent over the next decade. But at the same time, the demand – the actual butts-in-seats – will only go up 4 percent. So that is a divergence, which indicates there is probably going to be more aircraft retirements than proposed. And much of that product and used material still has a lot of useful life left."

The provenance of used-parts

When one member of the audience made a statement about the importance of the ‘provenance’ (or origins) of the parts, it begged the question of whether the age and pedigree of used material could devalue a newer aircraft. In response, Bill Correll, President and CEO of CFM Materials, had this to say:

"I think that it’s just one of the big challenges that we have in our business today. We have a lot of customers now who are coming in and wanting to know the time and cycles of every single part of an engine – whether it's time-tracked or not. Because, within a lot of leasing contracts, it will say that you need to put in parts that are as good as, or better than, what just came out and scrapped."

"Some people have interpreted this as, for example, if you take a 10,000 cycle part out, then you have to put a 10,000 cycle back in – regardless of whether it's a traditional time-tracked part or not."

"Another situation relating to the provenance of the parts, which we're also seeing a lot of, is when people are reluctant to accept parts that come from harsh environment engines."

Forecasting supply and demand

As the USM market is continuing to grow, questions are starting to arise regarding what kind of predictive tools could be leveraged to meet the growing demand for USM parts. When asked specifically if there were any big-data or AI tools that could help match part availability with the market demand, Kendrick responded jovially: "That sounds like a fabulous idea!"

Based on the exponential growth that the USM market is predicted to experience, it stands to reason that there is a tremendous opportunity for those looking to develop digital tools and software infrastructures to begin documenting industry-wide USM parts availability. Arguably, those that take the Amazon approach to this emerging market are going to gain a real competitive advantage in the coming years.

Bill Correll made this noteworthy point:

"I think one of the interesting questions around predictive technologies in regards to USM is that for accurate predicting tools, you need to provide data with transparency. Currently, the whole world of material trading is not a terribly transparent thing. It's not to say that this problem is not one that can't be overcome, but it is one of the major challenges we will see in the coming years."