Airbus and Boeing recently released their global commercial market forecasts that shine a light on the tremendous industry growth expected over the next two decades. In this article, we bring you the key figures you need to know to prepare your operations for tomorrow.

Although market forecasts by Airbus and Boeing vary slightly, both reports agree that the aviation industry can expect record-breaking growth in the years to come.

The rise of the middle-class in the Asia-Pacific region, combined with an ageing global fleet, are two essential factors driving demand for new aircraft to an unprecedented level.

Despise the fact that the aviation industry is soaring these years, there’s rising concern over whether or not the industry and the supply chain, in their current forms, can tackle the huge increase in demand.

Challenges remain

The concern is largely fueled by an ageing workforce and a projected lack of new pilots, cabin crew, and technicians across the world in the next 10-20 years.

LEARN MORE ABOUT:

The projected labour shortage and the challenges ahead in this article.

Furthermore, currently employed pilots and technicians will need training, so they can develop the skills necessary to fly and maintain the next-generation of aircraft that are set to dominate the skies in the future.

To find out exactly how the aviation industry will evolve over the next 20 years, we took a closer look at the commercial market forecasts released by Airbus and Boeing.

Below, you’ll find key figures with traffic and fleet size estimates on a global as well as regional level. We’ll also address the outlook for the global services market as well as important regulatory and environmental considerations.

Passenger traffic will double in the next 15 years

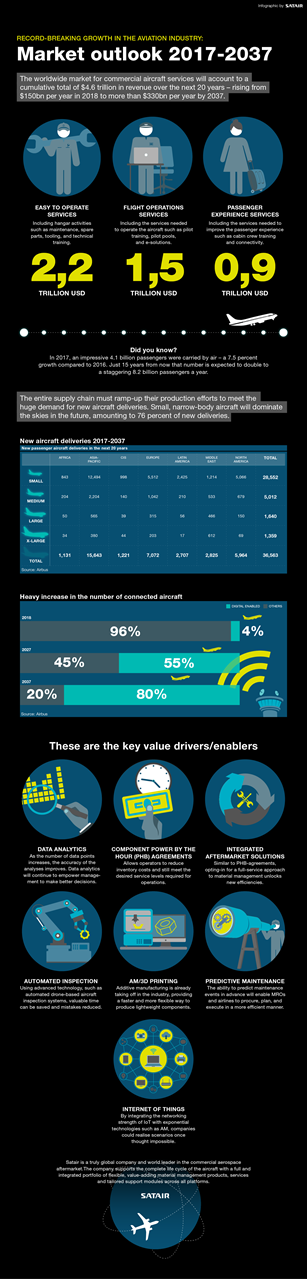

In 2017, an impressive 4.1 billion passengers were carried by air – a 7.5 percent growth compared to 2016. According to Airbus’ market outlook, just 15 years from now that number is expected to double to a staggering 8.2 billion passengers a year.

A large part of the future air traffic will be centralised around Asia-Pacific and the rising middle class in this region. As of 2018, the middle class represents 40 percent of the world’s total population – a number that will rise to 57 percent by 2037.

What’s interesting about air traffic is its resilience to external shocks, such as major changes in the global economy. The industry has historically been relatively unaffected by global GDP fluctuation, and this is thought to continue in the years to come.

Click infographic to enlarge/download

The world fleet will more than double by 2037

Airbus forecasts a demand for 37.400 passenger aircraft and freight aircraft over the coming 20 years. Boeing predicts a slightly larger demand, concluding that the industry will require 42.000 new aircraft by 2037.

Boeing’s and Airbus’ reports agree that the small segment of aircraft and narrow-bodies will dominate the skies in 20 years, representing approximately 76 percent of new aircraft deliveries and 54 percent of the total fleet value in 2037. The medium, large and extra-large segments will represent the remaining 24 percent of demand in units, but 46 percent of the value.

Asia-Pacific will account for the biggest share of new deliveries in the next 10 to 20 years. According to Airbus, 15.640, or 42 percent of the total new deliveries, will be going to this region.

To put that number into perspective, airlines in Europe and North America combined will account for 13.030, or 35 percent of the new passenger aircraft deliveries.

EXPLORE:

The top 10 risks the aviation industry is facing.

Market outlook by region

Looking closer at the reports from Boeing and Airbus, it becomes apparent that Asia-Pacific will soon grow to become the biggest and, in many ways, the most important region for the industry.

But the other regions of the world are also expected to grow and adapt to the customers’ future needs. We took a look at the trends, economics and demand patterns that characterise each region.

Market outlook: Asia-Pacific

Although India is now outpacing China in economic growth, China still remains a key economic player in the region. According to Airbus, Asia-Pacific will continue to lead world economic growth with expected average real GDP growth of +3.9 percent per year, over the next 20 years.

Tourism is playing an increasingly important role for Asia-Pacific, with the region being the second most visited region in the world after Europe in 2017. As a result, the region had a record-breaking year in 2017, with 636 million foreign arrivals – a record that is likely to be broken again multiple times over the course of the coming years.

Key figures: Asia-Pacific |

|

Market outlook: Europe

The European economy is expected to sustain recent years’ growth patterns in the long term, although uncertainties remain at the time of writing, largely due to Brexit. According to Airbus, the real GDP is expected to grow at 1.8 percent per year in the 2017-2037 period.

DISCOVER:

What you need to know to prepare your operations for the challenges of tomorrow.

Low cost- and ultra-low-cost airlines have grown significantly in recent years and their presence in the European airports is expected to continue to grow. Currently, 42 percent of the seats offered on domestic and intraregional routes are operated by airlines with low-cost business models.

The region continues to have the largest amount of international inbound arrivals in the world, with nearly 700 million passengers in 2017.

Key figures: Europe |

|

Market outlook: North America

According to Airbus, US expansion is becoming more balanced, with consumer spending, residential construction, business fixed investment, and government spending all contributing to sustained economic growth.

However, uncertainty remains due to trade-related tensions and their impact at both a regional and global level, and this will need to be monitored going forward.

The Real GDP is expected to grow by 2.0 percent annually, in the 2017-2037 period.

The US domestic traffic flow is the largest in the world today, but it’s likely that the flows in certain regions of Asia-Pacific will claim this title in the next 20 years. Still, the domestic traffic flow in the US will continue to be a major flow in the future, with a projected growth of 1.9 percent a year.

In the 2017-2037 period, the transatlantic route will add the most new passengers and have the highest new market potential.

Key figures: North America |

|

Market outlook: Middle East

The economy in the Middle East has been somewhat hindered in recent years due to low oil revenues, fiscal tightening, and some regional political instability. However, as oil prices recover, somewhat in the medium term, the economy is expected to grow at a stable rate in the 2017-2037 period.

The region’s real GDP is expected to grow by 3.4 percent annually, over the next 20 years.

With the Middle East’s geographical location, the ambition of the region’s airlines, and its young and growing population, traffic to and from the region has grown rapidly in recent years and will continue to do so in the next 20 years.

LEARN HOW:

Aircraft retirements will affect the supply chain.

The region is also an important hub for connecting passengers. In the last 10 years alone, the number of passengers connecting via a Middle Eastern hub has more than tripled.

To keep up with the growth, the region is reportedly planning to invest upwards of 100 billion USD to improve airports and the region’s infrastructure.

Key figures: Middle East |

|

Market outlook – Latin America and the Caribbean

Economic performance varies across Latin America. Brazil and Argentina are emerging from a heavy recession and there are also positive growth prospects for countries like Colombia, Chile and Peru.

Despite various long-term challenges, such as inadequate infrastructure and restrictive business environments, the long-term economic outlook for the region is positive.

The real GDP is expected to average 3.0 percent per year in the next 2017-2037 period.

Around 70 percent of the traffic to and from Latin America is within the region – 85 percent of which is domestic. This suggests there is an opportunity for greater intra-regional flying.

Key figures: Latin America and the Caribbean |

|

Market outlook – Commonwealth of Independent States

After two years of decline, the Russian economy - an important part of the overall CIS economic performance - has picked-up, led by upturns in consumer spending

and fixed investment, writes Airbus in their global market forecast.

Restrictions remain in the business environment of the region, and further structural and institutional reforms are needed in order in order to keep economic growth stable in the next 20 years.

The region’s real GDP is expected to grow at 1.9 percent annually, over the next 20 years.

In addition to tourism and business, which are the main the drivers of the aviation growth in the CIS region, demographic factors are thought to be able to help stimulate VFR (visiting friends and relatives) air travel in CIS in the years to come.

LEARN MORE ABOUT:

How airlines can benefit from achieving the connected aircraft

Russia has the third highest population foreign-born population in the world, many of which having relatives, family and friends in the other regions of CIS. As a result, three of the top five traffic flows over the next 20 years will be from, to, and between Russia and the other CIS countries.

Key figures: CIS |

|

Market outlook – Africa

According to economic forecasts, Africa will be one of the top performing regions in terms of future economic growth, due to various factors such as a recovering commodity market, expanding domestic markets, tourism, and a fast-growing population.

However, the region is still struggling with political instability and poor infrastructure, and these obstacles must be addressed before the region can realise its true economic potential.

The real GDP of the region is expected to grow at 3.4 percent per year in the 2017-2037 period.

Inbound tourism has grown significantly in recent years, and Africa is becoming an increasingly popular destination for Chinese tourists, especially. This is primarily due to the relaxation of visa requirements for Chinese nationals.

The region is also looking toward Europe’s liberalised aviation market in order to boost connectivity, reduce fairs and boost economic growth. In January 2018, 23 African nations took the first steps towards this goal.

The region’s fleet is still the oldest in the world, averaging 13 years old.

Key figures: Africa |

|

Service and aftermarket outlook

With so many new aircraft deliveries expected in the 2017-2037 period, the global MRO industry and aftermarket are set to experience strong growth.

Airbus’ Global Services Forecast (GSF) estimates that the fleet will more than double from 21.500 aircraft today, to nearly 48.000 aircraft in 2037.

RELATED ARTICLE:

Five emerging technologies that will change the MRO industry.

As a result, the aviation service market will also more than double in the next 20 years – rising from 150bn USD in 2018 to more than 330bn USD per year by 2037, or a cumulative total of 4.6 trillion USD over the next 20 years.

The total spend of 4.6 trillion USD in the 2017-2037 period can be grouped into three categories:

- 2.2 trillion USD to be spent in the area of “aircraft easy to operate”, including hangar activities, such as maintenance, spare parts, tooling, and technician training.

- 1.5 trillion USD to be spent in the area of “flight operations services”, including the services needed to operate the aircraft, such as pilot training, pilot pools, and e-solutions.

- 0.9 trillion USD to be spent in the area of “passenger experience”, including the services needed to maximise the flight experience, such as cabin upgrades, cabin crew training, connectivity, and booking.

Utilising innovative technologies will be key

Going forward, the biggest challenge for the MRO industry will be to find a way of maintaining a more technological and connected fleet, while also facing a heavy increase in maintenance activities, due to the many new aircraft coming into service in the 2017-2037 period.

Airbus suggests that innovative solutions, such as drone-based inspection systems, predictive maintenance, and IoT (Internet of Things) will play a vital role in addressing the MRO challenges.

RELATED ARTICLE:

Predictive maintenance the road to a proactive supply chain.

The area of inventory management is, too, set to evolve as airlines look for partners that can leverage the power of data analytics in the future. The data will enable material providers like Satair to provide the parts that the airlines and MROs need at the right time, without the need of stocking excess inventory.

Airbus also projects an increase in PBH-component agreements (Power by the Hour) and similar services, such as Satair’s IMS-solution, which allow airlines to secure and better predict their maintenance costs and focus on their core business of flying the aircraft.

The period ahead is characterised by an unprecedented increase in digitally enabled and connected aircraft. Previous generation single-aisle aircraft generated just 400 data parameters compared to 24.000 today.

Utilising this data with the help of digital technologies, such as predictive maintenance, will play an important role in optimising maintenance operations, scheduling and aircraft utilisation – and ultimately lead to more airline revenue and cost savings.

Thus, there is a strong opportunity for airlines that succeed in delivering the “connected” customer experience.

Regulatory changes set to further stimulate air travel

The legislation, visa and immigration policies have always influenced demand for air travel. However, in recent years there has been a global trend toward relaxing the regulations, as countries have witnessed the benefits open skies can bring in terms of business and tourism.

READ:

Regulatory changes in the horizon: How Brexit will impact the aviation industry.

Airbus projects that especially two recent government-driven initiatives will stimulate air travel – both domestically and internationally:

»In India, the Ude Desh Ka Aam Nagrik Regional Connectivity scheme or UDAN-RCS, is a government initiative designed to make domestic flying more accessible to the Indian population, by making it more affordable and convenient, whilst at the same time stimulating economic growth. In the first round, RCS-1, a total of 128 routes were awarded to 5 players,« Airbus states in their report.

The country, which is undergoing tremendous economic changes these years, is expected to add more routes to the program in the coming years, further stimulating travel by air.

Another important regulatory initiative to look out for is China’s much-discussed Belt and Road Initiative (BRI), which first launched in 2013. The BRI aims to connect Asia, Europe, Africa, and the Middle East with a vast logistics and transport network.

The initiative already appears to have had a positive impact on air travel to and from China for countries participating in the program.

RELATED ARTICLE:

Top 10 inventory management systems for MROs.

For instance, Kenya and Vietnam both have higher traffic rates to and from China during 2013-2017 than was the case before the initiative was launched. As the BRI matures, it’s likely that it will have a positive effect on the aviation industry.

The world demands sustainable air travel

The benefits of travelling by air are clear to anyone, but the industry must also recognise the environmental impact air travel is causing. According to Airbus, aviation currently represents around two percent of global man-made CO2 emissions.

However, going forward, it’s vital that the industry continues to push for climate-friendly alternatives to minimise the impact of the many new aircraft coming into service in the future.

Historically, the aviation industry has been very successful in cutting emissions. In the last 50 years, for instance, Airbus has cut fuel burn and CO emissions per seat/kilometre by more than 80 percent, NOx emissions by 90 percent and noise by 75 percent.

The OEM has continued to deliver improvements in their latest aircraft platforms, such as the A320neo and the A350 XWB with 15-25 percent less fuel burn, compared to the previous generation aircraft.

Going forward, the industry can benefit from working together with suppliers, universities, and other stakeholders to find more sustainable solutions.

In the longer term, Airbus predicts disruptive technologies in the areas of electrification and hybridisation will also provide significant benefits in addressing CO2, noise and NOx emissions.

MUST READ:

The biggest MRO industry disruptions.